P & G plans to build CPO factory in INDONESIA

International Freight Forwarding In Indonesia

NOL Group reported a first quarter 2011 net loss of US$10 million compared to a net loss of US$98 million in the same period last year.

NOL said first quarter 2011 revenue was US$2.4 billion, up 16 percent from a year ago. First quarter Core EBIT (earnings before interest and taxes) was US$13 million, compared to a Core EBIT loss of US$74 million in the same period last year.

"In spite of year-over-year volume growth, a softer than expected Lunar New Year period and rising fuel costs have interrupted our momentum," said NOL Group president and CEO Ronald D Widdows.

APL, the liner shipping business of NOL, reported first quarter 2011 revenue of US$2.1 billion. That was a 15 percent improvement over the same period a year ago.

APL announced a US$8 million Core EBIT loss compared to a US$89 million Core EBIT loss in the first quarter of 2010. Liner Shipping volume increased nine percent in the first quarter from a year ago. Average revenue per FEU (forty-foot equivalent unit) increased three percent. Vessel utilization in the first quarter was 92 percent.

"We lifted higher container volumes in the Asia-Europe and Intra-Asia trade lanes during the first quarter, and freight rates improved in the Trans-Pacific," said APL president Eng Aik Meng.

"But our emphasis must remain on operating efficiency, as well as slow-steaming our ships to conserve fuel and counteract the effect of rising fuel prices, which were 28 percent higher per metric ton in the first quarter of 2011 than they were in 2010.”

APL Logistics, NOL's supply chain management business, reported first quarter revenue of US$368 million, up 24 percent from a year ago. Core EBIT was up 40 percent in the quarter to US$21 million and the Core EBIT Margin was 5.7 percent, compared to 5.1 percent in the first quarter last year.

The improvements were attributed to higher volumes and recovering unit rates across logistics' various businesses. Contract logistics revenue increased 23 percent in the first quarter and international services revenue was up 26 percent.

"Our commercial performance continues to gain strength across multiple services which have been improving since the middle of last year," said APL Logistics president Jim McAdam.

"We've maintained a disciplined focus on cost of operations and are witnessing consistent growth in emerging markets - both in our international logistics business as well as in the contract logistics-automotive segments."

Market conditions remain uncertain. Increased operating costs - particularly related to fuel cost increases - and competitive pressure on rates are expected to continue for the near term. Should these conditions persist, results will be negatively impacted. Its focus remains on operating efficiency, cost reduction and high vessel utilization.

source: logasiamag.co/picture: google.com

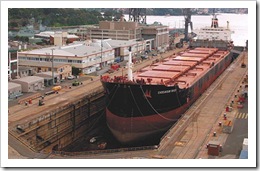

A total of three national shipping company will build a graving dock or maintenance ship are which separate from port with a total investment of IDR 2.4 trillion. This graving dock will be the first in Indonesia that capable of serving vessels of 100,000 DWT to 150,000 DWT.

Director General of Industry Leading High Technology-Based Industry Ministry Budi Darmadi said the three companies that plan to build a graving dock is Arpeni Group, Daya Radar Utama Group and Dok Kodja Bahari Group. Currently, the construction of facilities that are entering the process of land clearing. "Its construction will be completed within the next three years," said Budi.

Budi said Arpeni Group and Daya Kodja Bahari will built in graving dock in Batam. Meanwhile, Daya Radar Utama will build in Lamongan. They will build a graving dock that can accommodate vessels with a capacity of 100,000 DWT to 150,000 DWT. So far, the current graving dock is only capable of serving vessels up to 50,000 DWT.

Graving dock also prepared as the embryo of shipyard construction of LNG carriers in Indonesia, about 5 years. In preparation, the government is preparing experts to prepare a shipyard building LNG carriers in the country. "The government is sending about 100 experts for a year to countries that already possessed the technology such as South Korea and China," said Budi.

Meanwhile, Secretary of the Company PT Pertamina, Hari Karyuliarto said graving dock construction project has an important role if it is prepared to be a shipyard LNG carrier. "Mastery of the LNG carrier vessel technology must begin with the construction of graving dock facility," said Hari.

But according to the government step by sending experts to China or South Korea to build graving dock will not help efforts to master the technology of LNG carrier vessel. Government should emulate the Chinese who built the dry dock specialized LNG vessels and bring experts into their country, so transfer of technology will occur.

picture: google.com

Finally, Saratoga Group took over the Mandala Airline stocks by 51 per cent, followed by Singapore airlines, Tiger Airways, by 33 percent, and the remaining 16 percent by the old shareholders and its creditors.

The agreement was conveyed Head of Corporate Communication, Mandala Air Nurmaria Sarosa, Thursday (5/19/2011) in Jakarta. "God willing, Mandala will flight June or July 2011, "said Nurmaria. The agreement was signed in Singapore on Thursday afternoon.

Saratoga Group, an investment holding company founded by Edwin Soeryadjaya and Sandiaga Uno.

Tiger Airways is an airline which is majority owned by Singapore Airlines. Tiger Airways now flies 24 Airbus A320 aircraft. "Cardig and Indigo stocks was diluted in 16 percent of the shares are shared with other creditors," said Nurmaria.

Singapore media proclaim, Mandala Airlines will take the business model of low-cost airlines, like Tiger Airways, and still will operate the Airbus A320 with operational centers in Indonesia.

PT Mandala Airlines was established 17 April 1969 and was initially a part of the body of the Indonesian military. In April 2006, Indonesian transport group, Cardig International, acquired an airline with value at IDR 300 billion (34 million U.S. dollars). In October 2006, Indigo Partners, an investment firm, acquired 49 percent Cardig’s stake.

Mandala Airlines stops operations because of financial difficulties since January 13, 2011 and since April 1, had to lay off 50 percent of its employees.

Total debt of Mandala Airlines after verified reached IDR 2.45 trillion, which represents the amount owed to unsecured creditors. The amount is derived from about 114 creditors who are companies, 72,000 ticket holders that have been verified, and 350 travel agents. While Mandala’s assets that have beencal culated around IDR 110 billion.

picture: google.com

The data reported by units of foreign agricultural services, the U.S. Department of Agriculture or USDA Foreign Agricultural Service (FAS) in Jakarta said the oil palm industry (CPO) in Indonesia can produce as many as 25.4 million metric tons in the 2011/2012 marketing year that began in October 2011.

The increase CPO production is driven by the expansion of oil palm plantations in Indonesia significantly from year to year. The expansion of oil palm plantations in the period 2003-2009 came from small farmers or farm folk with an average growth of 7.19% per year.

Thereafter, followed by a private company which grew 4.98% per year. Meanwhile, ownership of the government palm plantation declined 0.63% per year in the period 2003-2009.

If the expansion of oil palm plantation remains the same as it is, ownership of small producers of oil palm plantations are expected to increase to 41% in 2012. Meanwhile, the trend growth of ownership by private gardens will remain steady at 52% in 2012.

By doing so, Indonesia's CPO production is expected to continue to grow. The reason is, so far in their fields, usually have a fairly good productivity.

With CPO production forecast of 25.4 metric tons in 2011/2012, implying growth of 1.8 metric tons per year. However, some local industries are not optimistic, they only predicted production growth of about 1.4 to 1.5 million metric tons per year.

picture: google.com

Finally, PT Mandala Airlines will back to operate immediately. The airline will soon fly again in June.

President Director of PT Angkasa Pura II Tri Sunoko claimed to have received a report from Mandala Airlines. "They said Mandala will fly again in June," he said.

Tri added that Mandala Airlines will occupy back Terminal III of Soekarno-Hatta Airport. However, Tri claimed not to know which type of aircraft will be operated by Mandala. "Clearly, we ready to prepare the airport for the arrival of the Mandala plane," he explained.

Director of Air Eligibility and Operation of Aircraft, Yurlis Hasibuan said that have not obtained a registration statement of the Mandala plane yet. However, he said, Mandala opportunity to fly is still very large. "SIUP still valid, just arrange a new routes and prepare the aircraft," he said.

According to Yurlis, if Mandala Airlines fly again, they will evaluate the Air Operation Certificate (AOC) who had submitted the Mandala since stopped operating in January. "AOC is likely to change because of the route and the aircraft must be tested before its feasibility," he explained.

After testing is completed, the new Mandala can fly commercially. Just to refresh memories, Mandala Airlines stopped flying since January 13 due to financial problem.

picture: google.com

Danish oil and shipping company A P Moller-Maersk reported an 85 percent rise in first-quarter net profit but reiterated it expects its 2011 bottom line to fall as container margins are squeezed, income from oil activities falls and exploration costs rise.

Maersk's first-quarter net profit rose to US$1.22 billion from $664.29 million a year earlier. Sales rose 11 percent to $15.28 billion from $13.71 billion.

Maersk, the world's largest container shipping company, also repeated it expects global demand for seaborne containers to grow by six to eight percent in 2011. Global tonnage is expected to match or grow more than freight volume, especially on Asia to Europe trade.

Freight rates, meanwhile, are expected to remain under pressure in the short term but strengthen in the second half of the year, Maersk said.

It said increased bunker and time charter costs are expected to continue to affect shipping margins negatively throughout 2011, and said its container shipping activities and its oil and gas business are seen generating full-year net results below those of 2010.

Maersk cautioned that the political unrest in North Africa and the Middle East has affected the oil price and may thus have a material impact on the company's results.

source: cargonewsasia.com / picture : google.com

The fall of Merpati Airlines, MA-60 aircraft to the waters of the Kaimana, West Papua, on Saturday (7 / 5) is the fifth time for an aircraft accident made in China. This accident is also the most fatal accidents have ever experienced MA-60 aircraft since the first time operated by Sichuan Airlines in 2000.

The first accident occurred on January 11, 2009. At that time, Xian MA-60 belong to Zest Airways flight 865 with 22 passengers and 33 crew members have undershot on Runway 06. The accident occurred when the plane landed at Godofredo P Ramos Airport, Philippines. Landing gear and propeller aircraft suffered severe damage. Three people were injured. However, there were no fatalities.

The second accident occurred on June 25, 2009. At that time, Xian MA-60 belong to Zest Airways flight number 863 with 54 passengers and 5 crews have overshot on landing at Godofredo P Ramos Airport. No injuries in the accident.

The third accident occurred on November 3, 2009. Xian MA-60 UM-239 owned by Air Zimbabwe hit five wild boar during takeoff from Harare International Airport. The plane managed to stop the takeoff process. However, plane was badly damaged in a collision.

Meanwhile, on December 7, 2010, the fourth accident occurred at Rangoon International Airport. Xian MA-60 aircraft at that time also skidded while landing.

The latest accident and the worst crash is Merpati Airlines MA-60 type in Kaimana, West Papua, on Saturday (05/07/2011) afternoon. The plane crashed and sank.

PT Merpati Nusantara Airlines (Merpati) ever stop operating (grounded) MA-60 aircraft made by Xian Aircraft of China following the damage to the rudder (wing section) back of the plane.

"Grounded we do because there was a crack on the rear wing," said (late) Director of Merpati Airlines, Bambang Bhakti after a hearing with Commission XI DPR-RI at the parliament building on Wednesday (10/6/2009).

picture: google.com

In the first quarter-2011, imports of fruits, especially for the type of mandarin oranges and pears from China, the more rampant. Data from Central Statistics Agency (BPS) shows mandarin orange imports in January-March 2011 amounting to 85,352,866 U.S. dollars. In fact, in the same period last year, import value of mandarin orange is still amounted 68,103,952 U.S. dollar. That means imports of mandarin orange in the first quarter 2011 jumped by about 25.32 percent compared with first quarter of 2010.

The same condition occurs in imported of pears. In fact, the increase in pears import value is much higher than mandarin oranges. Still referring to BPS data, pear imports in January-March 2011 amounting to 30,392,987 U.S. dollars. This value soared 168.56 percent compared with January-March 2010, valued at 11,317,116 U.S. dollars.

Chairman of Vegetables and Fruits Exporters Association of Indonesia (AESBI) Hasan Widjaja pleaded not too surprised with the increase in value of fruit imports from China. According to him, the fruits of China does have many advantages, such as lower prices and the availability of abundant supplies. Mandarin oranges from China, for example, can be sold to consumers at a price of IDR 17,000 per kilogram. Compare this with the Medan orange or Pontianak orange sold more expensive, which is IDR 20,000 per kilogram. "The traders automated choose orange imports," he told.

The availability of supply of fruit imports from China also became the cause of another. China already has a production area of fruits and vegetables that are adequate, both in terms of area and planting technology. In effect, they can produce fruits and vegetables continuously throughout the year without having hampered the weather.

The opposite happened to the fruits of Indonesia. Production of fruits in some areas often stuck due to bad weather. Indonesia also did not have a special area which is used as barns fruit production. As a result, every year the production of local fruits continue to fluctuate throughout the year."Traders obviously do not want to if its supply is uncertain," said Hasan.

Even so, Hasan acknowledged that there is some kind of fruit that had to be imported because Indonesia does not have it, like a pear. On the other hand, the demand for pears from the community continue to rise. Impact, to meet those needs, the import is the only way. "Pear did not exist in Indonesia. Can not help it, the import should be done," he said.

Meanwhile, Trade Minister Mari Elka Pangestu said must be wise in view of fruit imports from China. According to her, Indonesia has not yet entered the scale of dependence on imported fruits from China. However, imports are mostly for certain species that do not exist in Indonesia. "If there is demand, while supply does not exist, import is not anything wrong," said Mari in the press release.

picture: google.com

Singapore won the Best Seaport in Asia award for the 23rd time at the 25th Asian Freight and Supply Chain Awards (AFSCA) with the Maritime and Port Authority of Singapore (MPA) receiving the prize on behalf of local shipping community.

Among the 12 other nominees from Hong Kong, Shanghai Yangshan, Busan, Klang, Kaohsiung, Laem Chabang, Tanjung Pelepas, Manila, Ningbo, Shenzhen, Tianjin and Dalian, the Port of Singapore gained the highest number of votes from terminal operators, freight forwarders, shipping lines and shippers from across Asia.

Singapore was recognised for her cost competitiveness, container shipping-friendly fee regime, provision of suitable container shipping-related infrastructure, timely and adequate investment in new infrastructure to meet future demand and the facilitation of ancillary services, including logistics and freight forwarding facilities.

"Winning the Best Seaport in Asia award for the 23rd time clearly affirms the confidence the maritime community has in Singapore amidst growing competition in Asia. We will continue to work in close partnerships with the industry and stakeholders to develop Singapore as the port of choice in Asia, a premier global hub port and an international maritime centre," says MPA chief executive Lam Yi Young.

source: Shippingazette.com / picture: google.com

DECREE OF THE MINISTER OF FINANCE

No. 137/KMK.05/1997

ON

EXEMPTION OF IMPORT DUTY FOR IMPORT OF REMOVAL GOODS

THE MINISTER OF FINANCE OF THE REPUBLIC OF INDONESIA,

Considering :

that within the framework of implementing Law No.10/1995 on Customs Affairs, it is deemed necessary to regulate the provision on the granting of import duty exemption for the import of moved goods, in a decree of the Minister of Finance;

In view of :

1. Law No.6/1933 on General Tax Provisions And Procedures (Statute Book of 1983 No.49, Supplement to Statute Book No.3262) as already amended by Law No.9/1994 (Statute Book of 1994 No.59, Supplement to Statute Book No.3567);

2. Law No.7/1983 on Income Tax (Statute Book of 1983 No.50, Supplement to Statute Book No.3263) as already amended the latest by Law No.10/1994 (Statute Book of 1994 No.60, Supplement to Statute Book No.3568);

3. Law No.8/1983 on Value Added Tax On Goods And Services And Sales Tax On Luxury Goods (Statute Book of 1983 No.51, Supplement to Statute Book No.3264) as already amended by Law No.11/1994 (Statute Book of 1994 No.61, Supplement to Statute Book No.3568);

4. Law No.10/1995 on Customs Affairs (Statute Book of 1995 No.75, Supplement to Statute Book No.3612) ;

5. The Decree of the Minister of Finance No.25/KMK.05/1997 on Customs Procedures in the Field of Import.

DECIDES:

To stipulate :

DECREE OF THE MINISTER OF FINANCE ON EXEMPTION OF IMPORT DUTY FOR IMPORT OF REMOVAL GOODS

Article 1

Hereinafter referred to as moved goods shall be:

a. goods that, as a result of movement of its owner into Indonesia, are entered into Indonesian customs area, and

b. goods as meant in letter a above consist of household goods that are designated to remain a part of the household, and

c. excluding stock of goods and prohibited goods and motor vehicles.

Article 2

To the import of goods as meant in Article 1, an import duty exemption shall be granted.

Article 3

Import duty exemption shall be granted to:

a. Civil servants / ABRI members who, due to their duty, are placed abroad together with their families that is proven with Decision Letter of Placement Abroad and Decision Letter of Recall to Indonesia from the relevant department;

b. Civil servants / ABRI members who conduct study assignment abroad for at least 1 (one) year, either accompanied by their families or not, that is proven with Testimony of Study Assignment Abroad from the relevant department;

c. Students/university students/people who study abroad for at least 1 (one) year that is proven with testimony of study abroad and description of goods certified by representative of the Republic of Indonesia in the country of study;

d. Indonesian labours who are placed in the Indonesian representative office abroad for at least 1 (one) year continuously based on work agreement with the Minister of Foreign Affairs that is proven with testimony from representative of the Republic of Indonesia in the country of duty and work agreement with the Minister of Foreign Affairs;

e. Indonesian labours who, due to their duty, move and stay abroad continuously for at least 1 (one) year that is proven with testimony of move and description of goods certified by representative of the Republic of Indonesia in the relevant country;

f. Expatriates who, due to their duty, move into the Indonesian customs area together with their families who have obtained stay permit from the Directorate General of Immigration and expatriate work permit from the Ministry of Manpower for at least 6 (six) months that is proven by Stay Permit Card and Expatriate Work Permit for at least 1 (one) year;

g. Companies that move their activities into the Indonesian customs area after being able to prove their company liquidation abroad that is proven with Testimonial letter from the local Chamber of Commerce and Industry that has been certified by the representative of the Republic of Indonesia in the related country.

Article 4

Goods as meant in Article 3 shall arrive at the same time as the arrival of the relevant owner or at the longest 6 (six) months after or before the relevant owner arrives at Indonesia.

Article 5

For release of moved goods as meant in Article 1 by obtaining import duty exemption, the owner as meant in Article 2 shall submit Notification of Import of Certain Goods (PIBT) to the Customs Office Head by attaching:

a. detail of quantity and types of goods for which the import duty exemption and is customs value is applied;

b. Necessary Letters of Clearance;

c. photocopy of Passport.

Article 6

The Director General of Customs and Excise shall further stipulate technical provisions required for the implementation of provisions in this Decree.

Article 7

This decree shall come into force as from April 1, 1997

For public cognizance, this decree shall be announced by placing it in the State Gazette of the Republic of Indonesia.

Stipulated in Jakarta

On March 31, 1997

THE MINISTER OF FINANCE,

sgd.

MAR'IE MUHAMMAD

CLASSIFIED assessments of Guantanamo Bay War on Terror prisoners to Wikileaks include a Pakistani-national Saifullah Paracha, who worked as a New York City travel agent, report his detailed knowledge of the export/import business to smuggle radioactive and nuclear weapons in shipping containers of clothing.

The 63-year-old has been held at the Guantanamo Bay prison following his arrest in 2003 in Thailand when his son Uzair, now serving a 30-year sentence for terrorism-related charges, provided information of his links with al Qaeda since the 9/11 terror attacks on the US.

Paracha allegedly used his international shipping expertise to provide a small group headed by 9/11 planner Khalid Sheikh Mohammed with information regarding port security. He noted his concern to the group trying to smuggle plastic explosives through US ports' security saying it "would make it difficult to smuggle radioactive materials into the country".

The dossier also provided details on Paracha's link to money laundering and al Qaeda video production, though the American Civil Liberties Union says the information is unreliable, according to the New York Times.

source: Shippingazette.com / picture: google.com

Quantum Indonesia Translogistics was established in 2001 as an International Sea Freight forwarder and Air Freight Forwarder, Customs Brokerage, Project Cargoes, Domestic Shipments and Inland Transportation.

For more details please visit our website: Quantum Indonesia